$CVS: More Pain Ahead or Healthier than Ever?

Why this healthcare giant could crush the market in the decade ahead

Today we’re diving into the value prospects of CVS 0.00%↑after falling over 30% from its 2022 highs. We are going to evaluate the stock from 5 key focus areas: (1) Revenue Growth (2) Earnings Growth (3) Balance Sheet Strength (4) Free Cash Flow (5) Valuation.

Putting it all together, we’re going to assess whether or not we believe CVS has the potential to generate major returns for shareholders via the ‘trifecta’ of earnings growth, multiple expansion and shareholder value creation (dividends & buybacks).

As always, subscribe if you enjoy the content and join the discussion!

1. Revenue Growth

CVS has an exemplary history of top-line revenue growth, consistently compounding by over 10% per year.

Over the last 20 years, CVS has averaged a 13.8% top-line CAGR. Narrowing in on the last 10 years, this drops slightly to a 10.1% CAGR.

In the last 2 decades, CVS has only had 1 year where revenue dropped year-over-year, which was in 2010 when it dropped ~2%. Even then, revenue has compounded at the rates previously mentioned over long enough horizons.

As a result, I would expect revenue to continue growing over the next decade given CVS’ long operating history, even if this gradually slows to just under 10%.

→ PASS

2. Earnings Growth

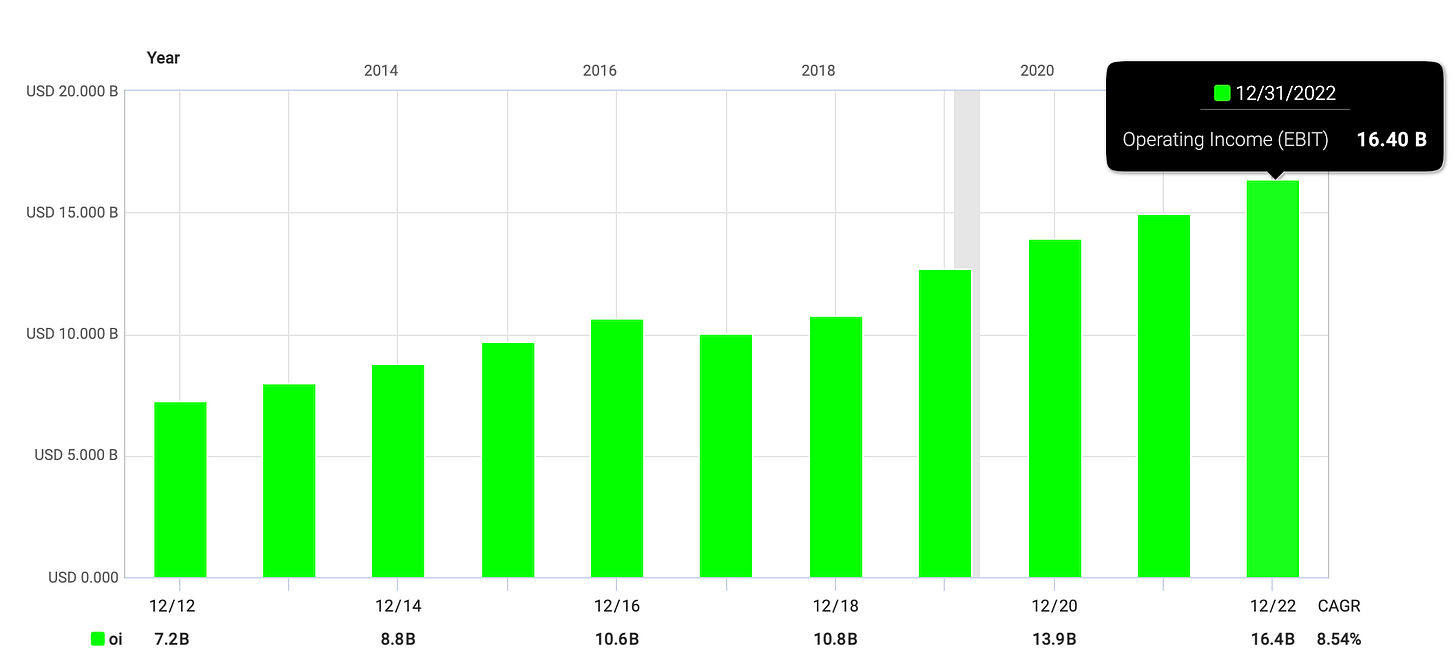

Similar to top-line revenues, CVS has a long track record of consistently growing earnings (in this instance measured as operating income or EBIT) over the last several decades.

In the last 10 years, CVS has compounded operating income by 8.5% annually and 13.9% annually if you extend 20 years back.

This is certainly impressive, however, I would prefer to see the business tracking operating income growth more closely to what we saw with revenue. i.e. More closely resembling the growth of 20 year period.

This tells me 2 things:

First, growth in operating income remains strong and stable, yet somewhat declining over time (albeit not close to concerning drops, just a nit). I would expect this to remain closer to 8-9% over the next decade, than I would 5-7%.

Second, the top-line revenue growth slightly outpaced operating income growth over the last decade, indicating the business could be losing some of its operating leverage due to various factors. Something to watch closely, however, still a pass here.

→ PASS

3. Balance Sheet Strength

Total Debt vs. EBTIDA

Your initial impression should be that this business carries quite a bit of debt at 3.4x EBITDA in FY2022 (4.2x debt to EBITDA as of Q3’23). HOWEVER, this is where most investors drop the ball evaluating CVS and other similarly situated businesses.

In general, I like to see businesses at < 3x debt to EBITDA and ideally gradually declining. That’s what I would give a pass in this category.

At surface level, CVS wouldn’t get a pass here strictly because debt to EBITDA as of the latest reporting period (Q3’23) was 4.2x, which is quite high. This is largely due to the acquisition of Aetna, which I will not speak to at length here.

Here are the critical factors to consider:

First, not all debt is collateralized against the business in the same way. Importantly, CVS has many physical retail locations that each enter into their own lease agreements. In other words, this does not carry the same level of risk that other debt/obligations would against the entire business. Almost a quarter of their debt comes from capital lease obligations, so the number looks higher than is really meaningful.

If you were to back out capital lease obligations, the debt to EBITDA ratio would be closer to 3.3x.

Secondly, CVS made a strategic acquisition of Aetna, which is the main driver of the inflated debt figure. Since 2019, the business has dramatically lowered the leverage on the business, declining the debt to EBITDA ratio from its 2019 high of 4.2x (adjusted for capital lease obligations).

Furthermore, with an interest coverage ratio of 5.5x as of Q3 FY2023 and FCF to Debt of 0.14x, the balance sheet is in good shape.

As debt is trending down rapidly following the acquisition of Aetna and noting the seemingly “overinflated” debt figure due to capital lease obligations, I’m going to give CVS a pass here.

→ PASS

4. Free Cash Flow

CVS’ free cash flow has largely trended upwards over time, with a tad more ‘lumpiness’ over the last several years, largely due to repayment of debt.

Free Cash Flow to Equity (“FCFE”) represents the cash that a company generates after accounting for capital expenditures to maintain or expand its asset base. It is an important metric for investors because it shows how much cash the company can distribute to its shareholders without harming its growth prospects.

The cash reflected in FCFE can be used in several ways to reward shareholders:

Dividends: This is a direct form of reward where cash is distributed to shareholders.

Buybacks: The company can buy back its own shares from the market, which can potentially increase the stock's value and benefit shareholders via reduced share count.

Reinvestment into the Business: The company might reinvest in its operations to drive growth, which can lead to increased future earnings and potentially higher stock prices.

Measuring Efficiency of Reinvestment: When it comes to measuring the efficiency of reinvesting back into the business, Return on Invested Capital (“ROIC”) is a key metric. ROIC measures how effectively a company uses the money invested in its operations.

CET = Capital Expenditures Total

CDP = Cash Dividends Paid

This chart is exactly what we want to see in a business that continues to grow free cash flow over time. As capex is largely flat (to very slowly growing) over time, this allows more of the cash from operations to be allocated towards the ‘reward shareholders’ bucket.

So how do we feel about the 3 areas shareholders could reap rewards with FCFE? Our preference in a well-established business like CVS would be to reward shareholders in the form of buybacks and dividend increases, so any reinvestment into the business needs to be scrutinized with a higher bar.

Dividends: CVS has a long history of consistently growing dividends, so they get a pass there.

Buybacks: This is a key area where CVS has not necessarily exhibited the trend we’d like as an investor in the business. However, this is also where we can unlock the most value going forward.

As CVS has aggressively paid down debt from the Aetna acquisition, our thesis is that more and more of the FCFE will go towards share buybacks in particular, ESPECIALLY considering CVS is trading at extremely attractive levels. This is also evident from the $3.5B in buybacks completed over the last year and management’s expressed desire to increase buybacks upon paying down debt to healthier levels. As a result, CVS gets a pass here.

Reinvestment into the Business: As ROIC has consistently remained relatively healthy at ~8% over the last 5 years, we will give a pass here, especially considering the current WACC is ~4.9% (ROIC should exceed cost of capital at a minimum).

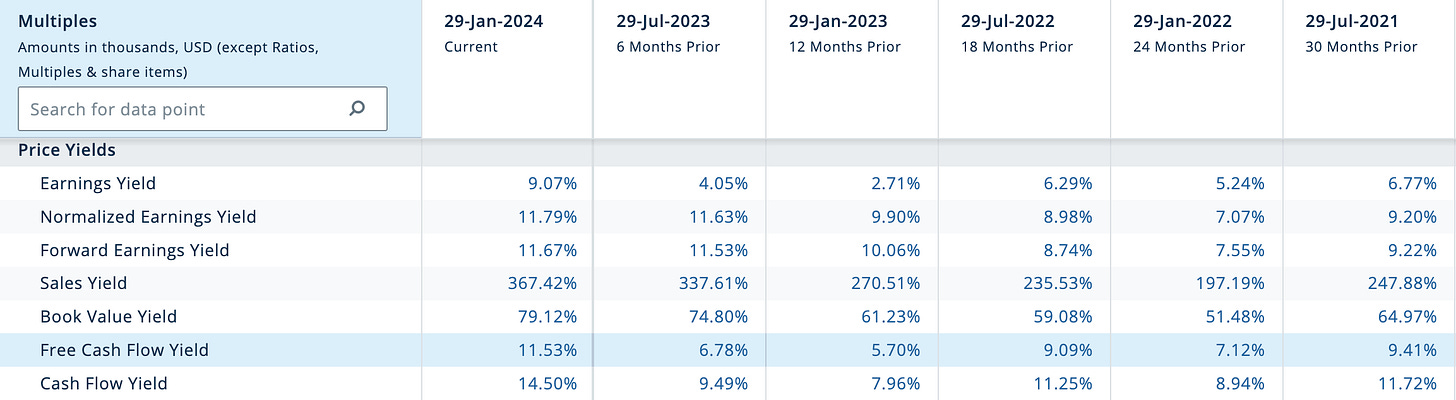

CVS also has a very high FCF yield of 11.5% (inversely related to the earnings multiple).

When a company has a high FCF yield, it suggests that a larger proportion of its valuation is backed by cash that can potentially be distributed to shareholders. This means that even if the stock's price appreciation (capital gains) is modest, the total return to investors can still be attractive due to the potential for cash distributions in the form of dividends and buybacks.

→ PASS

5. Valuation

Over the past 20 years, CVS has traded around 14-15x blended earnings (average of LTM/NTM) quite consistently. Over the last couple years, the company has slowly declined towards 8.5x earnings and looks oversold by historical measures.

Bear Case

5-Year EPS CAGR: 0.0%

PE Multiple: 8.5x

Assumptions are as follows:

Over the last 20 years, CVS has compounded earnings by 11.5% and 8.0% if you focus on the last decade. So I believe it’s quite conservative to assume no growth over the next 5 years, for a business that has decades of track record proving otherwise.

Regarding the multiple, we’ll leave as is and hold at a 8.5x blended PE.

I’m going to assume some combination of the following happens in this scenario:

CVS is hurt by elevated medical costs, particularly at its insurance unit, and uncertainties related to its Medicare insurance plans persist.

Health insurers like CVS, receive lower payouts for government-backed Medicare Advantage plans.

Retail locations suffer and store closures impact business.

With very conservative assumptions and a zero growth outlook, I would anticipate CVS to compound close to 3.6% annually though 2028 (assuming no dividends reinvested), which would largely be driven by dividend payouts. While it’s a poor outcome, reinvesting dividends should give you some protection. You’re assuming one of the worst growth periods in the company’s history and no multiple expansion, despite a 20-year track record indicating a higher multiple is reasonable at ~15x earnings.

Base Case

Assumptions are as follows:

5-Year EPS CAGR: 3.7%

PE Multiple: 12.5x

Over the last 3 years, earnings growth per share has slowed to 3.7% annually, so we’ll assume that in the base case.

Assuming a 12.5x PE as a benchmark, despite historical multiples being well in excess of this range. So this implies some multiple expansion over the next few years.

I’m going to assume some combination of the Bear case scenarios play out, but to a slightly lesser extent. So this is still a reasonably conservative base case by all measures but more of a continuation of the last 3 year trend line for earnings growth.

In the base case, where the business still grows well below the rates of the last 20 years, I would anticipate CVS to compound close to 14.7% annually though 2028 (assuming no dividends reinvested). This becomes very compelling relative to return expectations of the S&P 500.

Bull Case

Assumptions are as follows:

5-Year EPS CAGR: 5.0%

PE Multiple: 15.0x

Our bull case is essentially going to assume a marginally higher earnings growth rate relative to the base case.

Assuming a 15.0x PE as a benchmark, which is the 20-year average multiple for the stock.

In the bull case, where the business performs ‘okay’ (and still below the rates of the last 20 years ), I would anticipate CVS to compound close to 19.9% annually though 2028 (assuming no dividends reinvested). The bull case is still conservative and further demonstrates the attractiveness of CVS at ~8.5x blended PE.

Concluding Thoughts

When we’re looking for a great value stock, there are 3 key pillars that make a monster compounder over a long time horizon. Those pillars are (1) earnings growth (2) multiple expansion and (3) dividends & buybacks.

Earnings Growth

This is the weakest area of confidence for CVS candidly, but as some of the valuation sensitivities showed, any earnings growth should lead to healthy returns for shareholders. I find it unlikely a business as well-established as CVS will suddenly have 5-10 years of collapsing earnings.

Multiple Expansion

As CVS is trading near a historical low blended PE of 8.5x, I find it very reasonable to expect strong multiple expansion over a long enough horizon. I would likely hold until this returns closer to 15x, which is a major catalyst for shareholder returns over time.

Dividends & Buybacks

As CVS has a long track record of not only paying out dividends, but also increasing them, it is extremely reasonable to expect this should continue given the free cash flow generating capabilities of the business.

Furthermore, as CVS has aggressively paid down debt and will likely continue to do so, more and more free cash flow can go towards buybacks. As the stock is trading near historical low multiples, I expect management to be quite aggressive in returning value to shareholders in the form of buybacks over the next several years.

As a result, I think CVS has the potential to be a healthy compounder over the next decade, well surpassing returns of the S&P 500.

Join the discussion and let me know your thoughts!