TL;DR

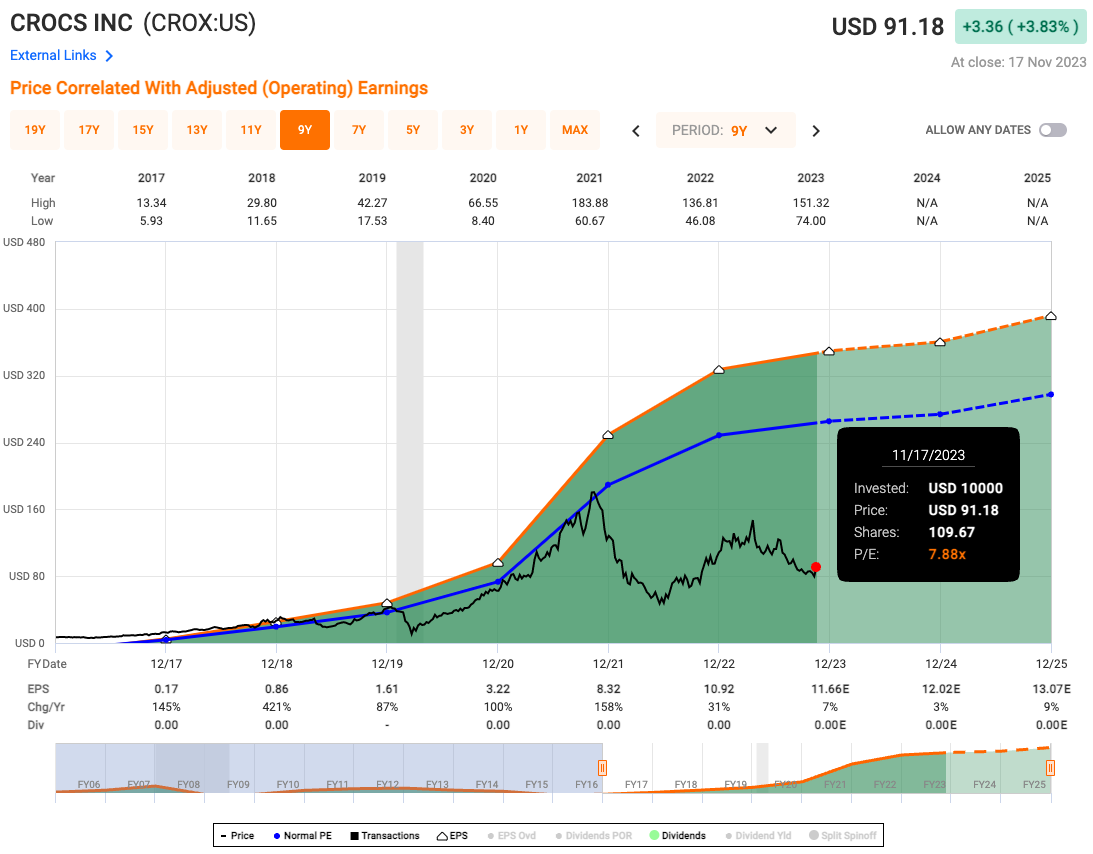

CROX 0.00%↑ has compounded earnings at almost 26% over the last 10 years, yet trades under 8x P/E after falling close to 50% since its 2021 highs, representing what I believe to be an attractive entry point from a risk-reward perspective.

Bull Case: Crocs has a proven track record of consistent earnings growth, while improving operating margins from 6.0% in FY2018 to 26.5% as of Q3 2023 under CEO Andrew Rees’ leadership.

Bear Case: Earnings growth is expected to slow to 5.0% annually through FY2024 due to recession concerns, which could impact consumer spending, and concerns surrounding the $2.5B acquisition of HEYDUDE, which was financed mainly through debt, currently represents 25% of Crocs’ total revenue and saw Q3’23 revenue decline 8.5% YoY due to a meaningful decline in wholesale performance.

Quick Business Overview

Crocs is a global footwear company known for its comfortable and distinctive clog-style shoes made from proprietary material "Croslite." The company sells casual lifestyle footwear and accessories for men, women, and children in over 85 countries. Its products are recognized for comfort, ease of cleaning, and water resistance.

Asia is an important driver of long-term growth, as revenue in China in particular grew 90% in Q3.

$604M in revenue or 16% of total revenue came from the Asia Pacific region in Q3, growing at a 30%+ CAGR since FY2020.

Crocs' distribution channels include wholesale, retail, and e-commerce, with a growing online presence. In February 2022, Crocs acquired HEYDUDE, a casual footwear brand, to expand its product range.

Q3’23 Revenue Breakdown

Financial Overview

Looking at the financials, it’s clear that this is a business that has performed exceptionally well over the last 5 years and realized a meaningful acceleration over the COVID pandemic.

Debt increased significantly in FY2022 related to the acquisition of HEYDUDE, which we’ll dig into shortly.

Despite concerns surrounding the HEYDUDE acquisition and revised performance expectations, Crocs is on pace to grow top-line revenue by 10.5% in FY2023.

Historical Revenue & Operating Income Growth

Pre-2018: Falling Out of Favor

Prior to 2018 (beginning around 2011), Crocs’ growth was largely inconsistent and relatively flat, while operating margins were equally unpredictable and rather disappointing.

2018 to Present: A Change in Tides

Upon the appointment of new CEO Andrew Rees in June 2017 (joined as President in 2014), the business began a new, and seemingly more consistent growth trajectory.

When Andrew Rees assumed the role of CEO at Crocs in 2017, he was faced with the challenge of revitalizing the brand. Rees changed the focus towards “clog relevance and sandal awareness.” This strategic pivot successfully attracted a new, younger audience, transforming Crocs from a primarily functional choice to a trendy, sought-after fashion statement. This remarkable turnaround pulled the company back from the brink of bankruptcy. The brand's renewed popularity is evident in its cultural impact, with notable artists like Post Malone mentioning Crocs in his music, specifically in "I'm Gonna Be," where he references "thousand dollar Crocs."

Andrew Rees also undertook significant restructuring measures by cutting 180 positions and shutting down more than 170 retail outlets and production facilities by 2021. Concurrently, the company focused on enhancing its direct-to-consumer capabilities, notably through the expansion of its own retail and online sales platforms. Presently, e-commerce comprises approximately 38% of Crocs' total revenue.

As of Q3, operating margins reached 26.5%, up from negative 0.3% at the end up FY2016, 2 months prior to Andrew’s appointment. Similarly, top like revenue has compounded at 22.8% annually since 2016.

Furthermore, the COVID pandemic only accelerated consumer appetite for Crocs → Read more in a piece by “The New York Times.”

Simply put, Andrew Rees has done a phenomenal job revitalizing the brand and creating a more efficient business model by increasing e-commerce distribution relative to physical retail expansion.

Balance Sheet Evaluation

From a balance sheet perspective, the HEYDUDE acquisition was financed primarily though $2.0B of debt. At the time of the acquisition, management enforced a commitment to use free cash flow for debt repayment and would pause all share buybacks through 2022 and until gross leverage was below 2.0x.

Since the acquisition, management has demonstrated this commitment towards debt repayment. As of the latest Q3’23 earnings update, the gross leverage ratio was 1.7x and $940M has been repaid since the acquisition.

With an interest coverage ratio of >6x and FCF to Debt of 0.3x, I don’t see a great deal of balance sheet risk. Furthermore, management has resumed share buybacks and is already close to the long term net leverage target of 1.0-1.5x.

Why Did Crocs Sell Off?

Crocs experienced a significant share price drop following the acquisition of HEYDUDE, a lesser-known footwear brand, announced in December 2021 and finalized in February 2022. Naturally as recession concerns increase, growth expectations slow for consumer brands like Crocs. Crocs’ acquisition of HEYDUDE only increased these concerns for investors.

Crocs paid a hefty $2.5B for HEYDUDE, a valuation of 15x its EBITDA. HEYDUDE had demonstrated remarkable growth, increasing sales from $20M to approximately $500M within four years, outpacing even Crocs. However, this acquisition raised concerns about the sustainability of both brands, leading to a dramatic market reaction with Crocs' share value plummeting by around 75% by mid-2022.

Since mid-2022, Crocs’ share price has recovered some, but the ongoing concern with the business comes down to performance of the HEYDUDE brand. FY2023 guidance for the brand has continued downward revision, most meaningfully in Q2 and Q3 of this year.

So our full year, HEYDUDE guidance on a reported basis is 4 to 6% on a pro-forma basis. So that implies that our Q4 growth for HEYDUDE, our Q4 would be negative 20 to negative 25 is the revenue guide.

Q3 2023 Earnings Transcript

HEYDUDE Acquisition

In November 2021, Crocs announced they would be acquiring HEYDUDE for $2.5B. The deal was completed in February of 2022. Crocs had previously focused within the clog and sandal segments of the footwear market and HEYDUDE would immediately expand their offerings to the casual footwear category, where Crocs was vacant.

Let’s start with the first question. Did Crocs overpay for the business at ~15x EBITDA? Let’s look at a few comparable companies and the multiples they were trading at then vs. now. The below peer group and available HEYDUDE data is based on Crocs’ analysis as part of the HEYDUDE acquisition presentation to investors, with one addition in Birkenstock which went public in 2023.

Reasonableness Check

While comparing the acquisition to current EV/Revenue and EV/Forward Revenue multiples implies a meaningful overpay, my opinion is that the best measure of valuation here remains EV/EBITDA given the HEYDUDE’s high growth and profitability relative to lager peers.

As a result and all else equal, it seems Crocs’ acquisition of HEYDUDE was completed at a reasonable price at only a 11.4% overpay in today’s environment “terms.”

Now let’s move on to the bigger question. What is the current value of HEYDUDE and how is the business performing relative to expectations?

Actuals vs. Guidance

In short, this is a tale of 2 years. In FY2022, HEYDUDE demonstrated strong top-line growth, beating management’s initial guidance by 36%. As a result, Crocs again achieved record revenue on the year and saw its stock price climb 175% from its mid-2022 lows by April 2023. FY2022 showed a glimpse of what Crocs saw in the HEYDUDE brand and began to qualm some of investor concerns.

By mid-2023, management had revised HEYDUDE’s growth outlook on the year multiple times and began to re-fuel some of investor concerns surrounding the strength and long-term growth potential of the brand.

When Crocs incorporated HEYDUDE into its distribution network, this led to a significant acceleration of the brand’s retail footprint, contributing to the initial high growth rate in FY2022. A substantial portion of this growth, approximately $220 million or 22% of HEYDUDE’s FY2022 revenue, was due to initial inventory orders from retailers.

I’m more optimistic on HEYDUDE. Crocs’ plans to leverage its successful marketing strategies and introduce new designs and models for the brand that made Crocs so successful.

Furthermore, a significant opportunity lies in international expansion, mirroring the success of the Crocs brand, potentially adding a substantial amount to HEYDUDE’s revenues in the future. About a 1/3 of Crocs’ revenue comes from international sales, while HEYDUDE generates a majority of revenues from the US. This should give you an idea of the brand’s ultimate growth ambitions and the opportunity at hand.

So what is HEYDUDE worth today? Looking at our peer group, we’ll apply at 13.3x EV/EBITDA multiple. As EBITDA for the brand on a standalone basis isn’t readily available, we’ll use 23.6% operating margin as of FY2022 as a proxy (so expect some variability from actuals).

TTM Operating Margin: ~$245M

Implied Valuation of HEYDUDE: $3.3B

Implied Valuation of HEYDUDE (ex-$BIRK multiple): $2.8B

While some of the actuals are a bit fuzzy here, the overall point is that when you take a step back and account for some of the short term, one-time efficiencies HEYDUDE realized in FY2022 and look at the overall growth since the brand acquisition, the outlook remains strong. While I don’t think Crocs acquired HEYDUDE at a steal of a deal, I think the acquisition price was reasonable and the brand has performed well enough to be well beyond any impairment concerns.

Valuation

Okay, so now let’s get back to the entire business. What do I think Crocs is worth today? Crocs currently trades under 8x earnings, far below its 18-year historical average of 20.6x earnings. So in a vacuum, it’s reasonable to assume that this stock looks cheap. But now we need to differentiate cheap from value.

In order to do so, let’s look at three scenarios and assess the underlying risks in each. In my estimation, the most impactful critical risks facing the business in order of significance are:

Recession Concerns

HEYDUDE Brand Performance

International Growth

Of course, other risks remain, but when evaluating the growth levers for the business, the inverse of these risks remain the biggest opportunities going forward (in my view).

Analyst Estimates & Track Record

1 Year Out Track Record

2 Years Out Track Record

Bear Case

Assumptions are as follows:

Between 2010 and 2018, EPS grew at a CAGR of 1.56% and given this was one of the company’s worst eras, I’m going to underwrite to the same growth rate.

Over that same period, the PE ratio remained well above 10x (often above 15x), but to be conservative, I’ll assume a 10x PE as a benchmark.

I’m going to assume some combination of the following happens in this scenario:

Crocs gets hit hard by a recession and consumer pull back spending meaningfully.

HEYDUDE performs well below expectations and becomes an impaired asset.

Asia Pacific expansion slows dramatically.

Despite conservative assumptions and a meager growth outlook, I would still anticipate Crocs to compound close to 6.4% annually though 2028. This is certainly not an ideal outcome for an investor, but it’s a far cry from a poor outcome considering this is the bear case. You’re effectively assuming next to no growth but some multiple expansion given how low the business trades relative to earnings.

Base Case

Assumptions are as follows:

7.88% CAGR through 2028, which implies a PEG ratio of 1.0x indicating the asset is trading at a relatively fair price today.

Assuming a 12.5x PE as a benchmark, despite historical multiples being well in excess of this range.

I’m going to assume some combination of the following happens in this scenario:

Recession fears are overblown and impact to the business is less significant than expected.

HEYDUDE performs reasonably well and becomes a strong growth vector for the business.

Asia Pacific expansion continues along a strong growth trajectory.

In the base case, where the business grows well but below the rates of last 5 years, I would anticipate Crocs to compound close to 18.0% annually though 2028. This truly demonstrates how attractively priced Crocs is at current levels.

Bull Case

Assumptions are as follows:

10.00% CAGR through 2028, which implies a PEG ratio of 0.79x indicating the asset is trading at an extremely attractive range.

Assuming a 15.0x PE as a benchmark, despite historical multiples being well in excess of this range.

I’m going to assume some combination of the following happens in this scenario:

Recession impact is minimal and both the Crocs and HEYDUDE brands perform well as reasonably priced options for spend-sensitive consumers.

HEYDUDE continues to benefit from synergies with the Crocs brand and growth meets management’s expectations at the time of the acquisition (~20% long-term growth).

Asia Pacific expansion goes extremely well and HEYDUDE international launch follows similar trajectory as Crocs.

In the bull case, where the business performs very well (and still well below the rates of the last 5 years), I would anticipate Crocs to compound close to 24.7% annually though 2028. The bull case is still quite conservative and further demonstrates the attractiveness of Crocs at a sub 8x PE relative to the risks in the bear case.

Concluding Thoughts

In general, I like the risk-reward profile of CROX 0.00%↑ and maintain that the current valuation overstates the potential headwinds facing the business. In an oversimplification, Crocs is a business that has compounded earnings at 21.75% annually since 2005. At sub 8x earnings and assuming even half of this growth rate over the next decade, you’re looking at a business valued at a 0.72x PEG ratio.

Given the financial strength and track record of the business and current management, I’m quite confident that over a long enough horizon Crocs will generate strong earnings growth and in turn, benefit from multiple expansion as a result of improved investor sentiment.

Join the discussion and let me know your thoughts!