$CROX: 1-Year Review

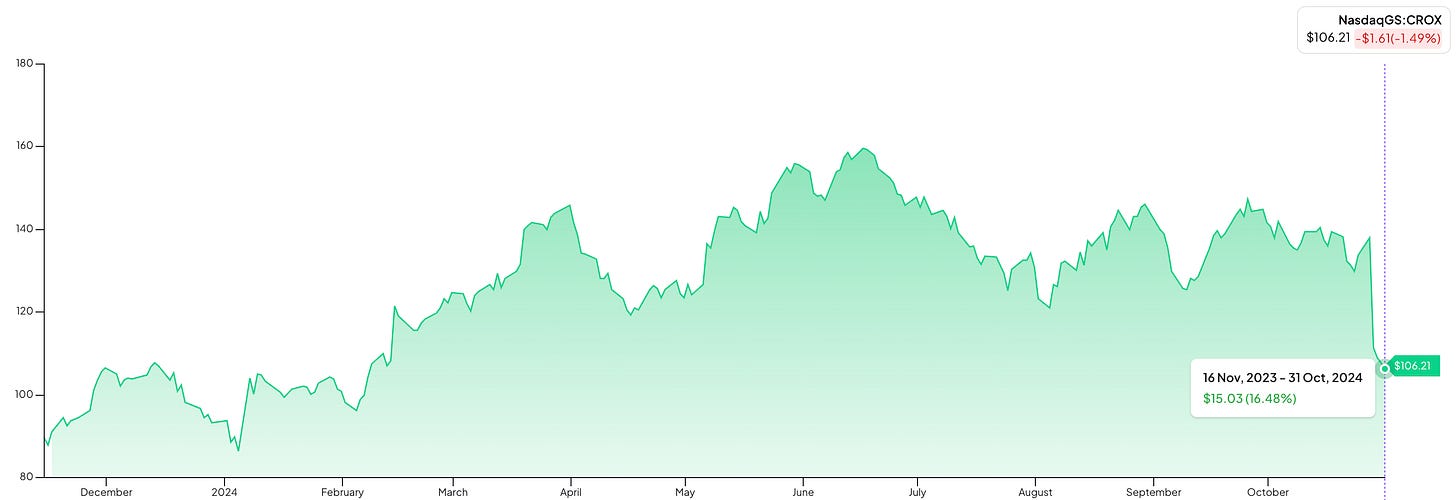

Crocs is up over 25% over the last 12 months, marred by the 20% decline following Q3'24 earnings

Last November, we took a deep dive into CROX 0.00%↑, which at the time was trading near $91 per share. Over the last year, the company traded as high as 80% above those levels, validating the stock as a great value play with major growth potential.

However, the company has once again come under criticism following its Q3’24 earnings, declining 20% on the release and muting our returns since initiating coverage to a ~16.5% total gain. While concerns surrounding the growth of HEYDUDE and the ‘Diworsification’ of the brand following the acquisition are certainly valid, Crocs once again looks like a strong value contender as it dips below 8.5x blended earnings (average of LTM/NTM), its lowest multiple of earnings since Q1 of this year.

We’re going to review our original thesis through the lens of 5 key focus areas: (1) Revenue Growth (2) Earnings Growth (3) Balance Sheet Strength (4) Free Cash Flow (5) Valuation to determine whether our original thesis has meaningfully changed. If you want a primer as to why we originally found Crocs to be a compelling value investment, please review the original post below:

11/19/2023: Initiating Coverage - $CROX Analysis: Fad or Here to Stay?

Return: 16.5%

TL;DR

Total revenue for FY2024 is expected to cross $4.0B for an increase of 3.0% year-over-year.

Earnings growth is expected to be relatively flat in FY2024, representing a slowdown in earnings growth.

Debt to EBITDA is now below 1.5x, as the company continued to pay down debt following the HEYDUDE acquisition (down to $1.4B from $1.9B in Q3 of last year).

FCF margin continues to trend up, growing to 23.1% as of the trailing twelve months (“TTM”) through Q3 2024.

Crocs trades at its lowest levels since Q1 of this year, trading to below 8.5x blended earnings (measured as the average of LTM/NTM). Comparably, peers such as Deckers (DECK 0.00%↑ ) and Birkenstock (BIRK 0.00%↑) trade above 30x blended earnings.

SWOT Analysis

Revenue Growth

Revenue growth is expected to slow to 3% at year end, primarily driven by the declining sales in the HEYDUDE brand. While the Crocs brand continues to grow at a healthy clip, the HEYDUDE turnaround has taken longer than management originally expected, generally causing market sentiment to remain negative on the overall business.

Crocs YoY (“year-over-year”) revenue growth is expected to close at 8%, in-line with Q2 guidance and 3% above original guidance from Q4’23.

North America growth was up marginally at 2% YoY, but management noted consumers are generally returning to more normal buying patterns post-pandemic and postponing retail purchases for certain times of the year (i.e. holidays, back to school, etc.).

Growth in China continues to be phenomenal at over 20%, where most of the brand’s growth is taking place.

HEYDUDE YoY revenue growth is expected to be -14.5%, down over 5% from Q2 guidance and well below original guidance last year assuming flat growth for the brand.

Management noted that performance marketing efforts for the HEYDUDE brand were not generating strong enough ROIs and were shifting the strategy towards brand marketing, with recent partnerships like Sydney Sweeney.

One of the key decisions that we made in the third quarter is we pulled back on performance marketing for the HEYDUDE brand. As we have looked at the sort of multiyear trajectory, our level of performance marketing had been creeping up. I would say the marginal ROIs were still positive, but they were not where we wanted them to be.

- Andrew Rees, Q3 2024 Earnings

Investing in the HEYDUDE brand is a key initiative for management, however, the impact will generally take longer than a successful performance marketing campaign where you may see faster ROI. The shift in strategy is showing positive near term signals, as average selling prices (“ASPs”), ticked up 4% in Q3.

In general, I echo the market sentiment that the key risks going forward concentrate around the performance of the HEYDUDE brand. That being said, I do believe the shift towards investment in brand marketing should produce stronger long term results, as management has demonstrated their competencies in building up the Crocs brand. Furthermore Terence Reilly, who was recently appointed EVP and President for the HEYDUDE brand, has a strong track record in revitalizing brands, most recently as President of Stanley Brand where he deployed a similar playbook.

Overall, I’ll continue to give management the benefit of the doubt given their resounding confidence in the HEYDUDE brand and recent pivot in marketing strategy, which should align well with long term value creation.

→ PASS

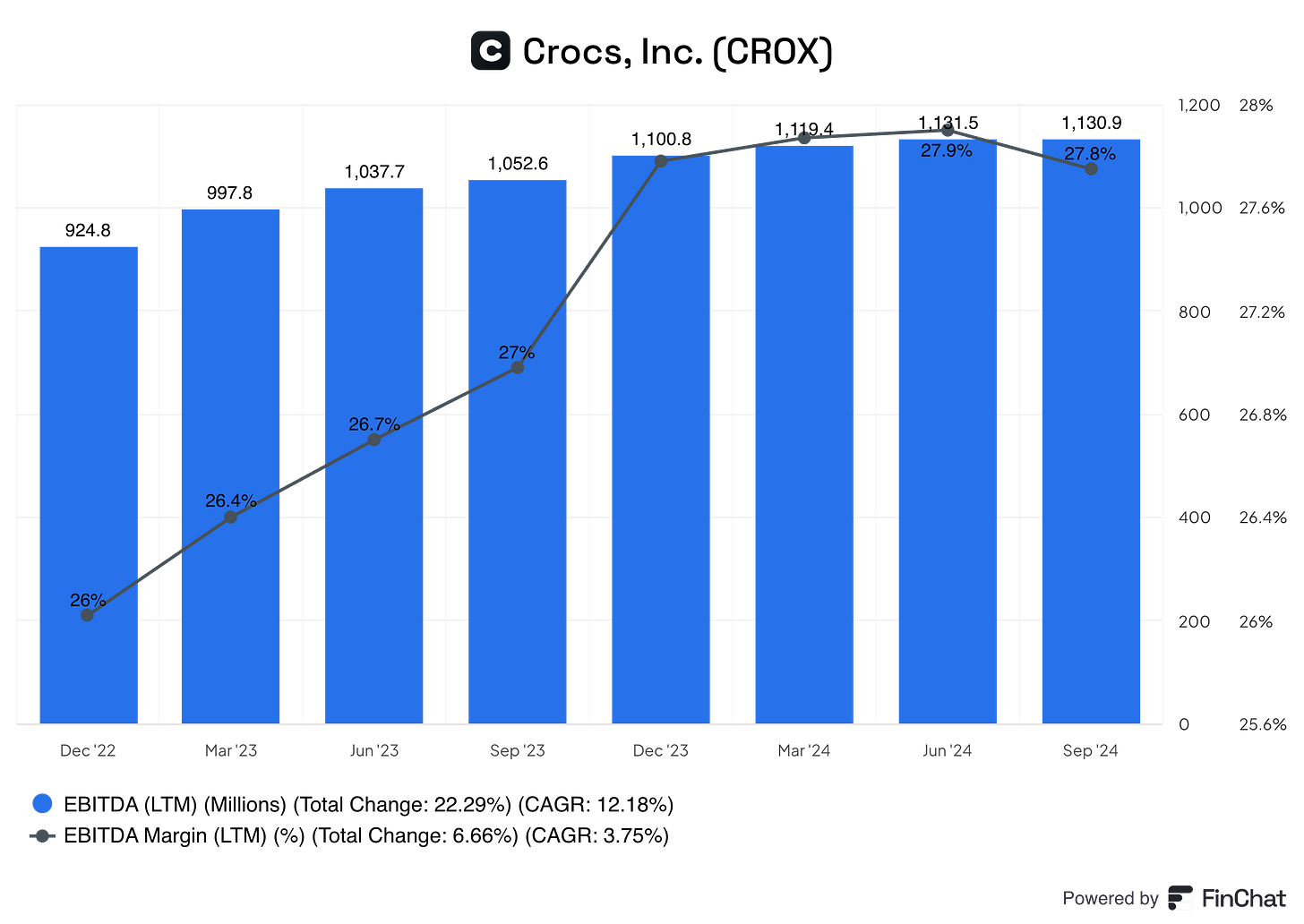

Earnings (EBITDA) Growth

Crocs has maintained incredibly healthy EBITDA margins above 25% since 2021, placing it in the best-in-class category amongst its peers. However, on a TTM basis, the operating margin has begun to decline slightly as of the latest quarter. Since 2021, EBITDA has compounded at an 18.1% CAGR compared with 22.8% for top-line revenue.

This tells me a couple things:

First, growth in operating income remains strong and stable, yet somewhat showing signs of decline given the underperformance of HEYDUDE (albeit it very slight and still incredibly healthy levels).

Second, the top-line revenue growth slightly outpaced operating income growth over the last several years, indicating the business could be losing some of its operating leverage, again largely driven by HEYDUDE.

Overall, operating margins are just too high to be meaningfully concerned yet, especially as compared to the broader peer group (we’ll get into this later). However, should management continue to invest heavily into the HEYDUDE brand without realizing an ROI, overall margins are likely to continue sliding. In short, something to monitor but overall a pass.

→ PASS

Balance Sheet Strength

Crocs has $186M in cash on the balance sheet, while the HEYDUDE acquisition was financed primarily though $2.0B of debt. At the time of the acquisition, management enforced a commitment to use free cash flow for debt repayment and would pause all share buybacks through 2022 and until gross leverage was below 2.0x.

Since the acquisition, management has aggressively paid down debt, reducing the balance by almost $500M since Q3 of last year and resuming buybacks.

Q3 2024 Snapshot

Q3 2023 Snapshot

As debt to EBITDA is now below 1.5x, Crocs is in great shape from a balance sheet perspective and has reinforced its commitment to continue paying down debt while aggressively buying back shares. As of the latest earnings, Crocs still has $549M remaining on a buyback plan, which should be a major catalyst for the stock over the next year.

→ PASS

Free Cash Flow

Free Cash Flow (“FCF”) represents the cash that a company generates after accounting for capital expenditures to maintain or expand its asset base. It is an important metric for investors because it shows how much cash the company can distribute to its shareholders without harming its growth prospects.

The cash reflected in FCF can be used in several ways to reward shareholders:

Dividends: This is a direct form of reward where cash is distributed to shareholders.

Buybacks: The company can buy back its own shares from the market, which can potentially increase the stock's value and benefit shareholders via reduced share count.

Reinvestment into the Business: The company might reinvest in its operations to drive growth, which can lead to increased future earnings and potentially higher stock prices.

Crocs continues to maintain an incredibly strong FCF margin above 20%, once again placing it in the best-in-class category amongst its peers. As Crocs hasn’t elected to pay dividends, FCF will primarily drive allocation towards buybacks and reinvestment going forward.

Measuring Efficiency of Reinvestment: When it comes to measuring the efficiency of reinvesting back into the business, Return on Invested Capital (“ROIC”) is a key metric. ROIC measures how effectively a company uses the money invested in its operations.

This chart is exactly what we want to see in a business that continues to grow free cash flow over time. As capex is somewhat flat (down this year technically) over time, this allows more of the cash from operations to be allocated towards the ‘reward shareholders’ bucket.

So how do we feel about the 3 areas shareholders could reap rewards with FCF? Our preference in a higher growth business like Crocs would be to balance rewarding shareholders in the form of buybacks and dividends with reinvestment into the business. Most importantly on this note, is that Crocs has continued to invest into the business, especially with the acquisition and marketing spend in HEYDUDE. To date, this hasn’t realized a great ROI for the brand, but in aggregate, Crocs continues to produce an incredibly high ROIC at near 25%.

Furthermore, there is a great deal of literature that suggest high ROIC business generally outperform overtime (for obvious reasons). Crocs’ ROIC is well above most peers at levels near Nike (NKE 0.00%↑) and Deckers (DECK 0.00%↑) which are both exceptionally high for any industry.

Share Buybacks: As of Q3 2024, Crocs has approved $549M share buyback program remaining. The company has proven to be one of the best performing stocks over the last 5 years, partially driven by management’s aggressive buyback plans. I expect this should continue as the balance sheet only strengthens with the rapid repayment of debt. Despite the HEYDUDE acquisition and ensuing debt, buybacks have continued and shares have declined by an average 3.1% CAGR over the last 2 years.

Crocs also has a very high and increasing FCF yield of 15.0% (inversely related to the earnings multiple).

When a company has a high FCF yield, it suggests that a larger proportion of its valuation is backed by cash that can potentially be distributed to shareholders. This means that even if the stock's price appreciation (capital gains) is modest, the total return to investors can still be attractive due to the potential for cash distributions in the form of dividends and buybacks.

→ PASS

Valuation

Crocs currently trades under 10x earnings and below 8.5x blended earnings (again, average of LTM/NTM). This puts CROX 0.00%↑ in deep value territory, as its trading at 50% or less of many of its industry peers from a multiple perspective. The business is still exhibiting strong growth and simultaneously demonstrating strong profitability, despite challenges with HEYDUDE in the nearer term. I believe the stock is well oversold on fears of HEYDUDE, which I believe management can develop into a strong brand with high growth potential in the coming years.

When compared with its comparable set above, a few things should be noted:

EBITDA Margin - Crocs has well above the industry median and leads all its peers

FCF Margin - once again, Crocs has well above the industry median and leads all peers

ROIC - Crocs lags only Nike and Deckers in ROIC, which is generally correlated with strong stock performance and a great marker for management’s capital allocation competency

In general, I believe significant multiple expansion is reasonable given the expected growth rates and profitability. In general, many of its peers trade well in excess of 15x earnings (many higher than 20x earnings).

Note: Blended P/E is based on the average of LTM and NTM earnings.

Assumptions are as follows:

5-Year Earnings CAGR: 5.7%

P/E Multiple (Blended): 12.5x

The return model is essentially going to assume a meaningfully lower earnings growth rate relative to the average ~16% over the last 3 years.

Assuming a 12.5x P/E as a benchmark, which is quite conservative based on where Crocs’ peers generally trade and below the 15x average multiple of the last 5 years. For reference, Crocs traded up to this level in June of this year.

In the return model, where the business performs well (but below the rates of the last several years), I would anticipate Crocs to compound close to 14.4% annually though CY2029, leading to a 2x in just over 5 years.

Concluding Thoughts

The general takeaway is that Crocs trades at too compressed a valuation for a business that operates at such superior margin profiles and capital efficiency relative to its respective industry.

Even if growth doesn’t mirror the boom following the pandemic, the business is trading at such a low multiple that you have the major buffer/benefit of likely multiple expansion vs. further multiple erosion. I believe Crocs is a fantastic value candidates to realize the trifecta of a great investment:

Multiple Expansion - Crocs’ multiple is more likely to expand over a long enough horizon than it is to compress.

Earnings Growth - Crocs’ earnings have continued to grow despite headwinds with HEYDUDE and I believe earnings will continue to grow into the future, even if at a lower rate than historical levels.

Shareholder Value - Crocs has a proven history of returning value to shareholders in the form of aggressive buybacks, which should only continue given the $500M+ in buybacks currently open and the premium FCF margin that the company commands relative to its peers.

Join the discussion and let me know your thoughts!

great write up, even without heydude this brand has to be worth more than its currently valued. The margins and FCF and crocs brand I think is stronger than what the market is pricing it as - a fad

Excellent write up, I have pretty much made the same case elsewhere.

Do you have any insight on India specifically? There's no disclosure on the number of stores on the 10-k for some reason..?