Each week, I’ll provide a glimpse into the stock screening I perform to identify value candidates. Over time, I will provide advanced metrics to track certain trends within my value screener and hopefully clean things up to make this an overall better experience for you readers!

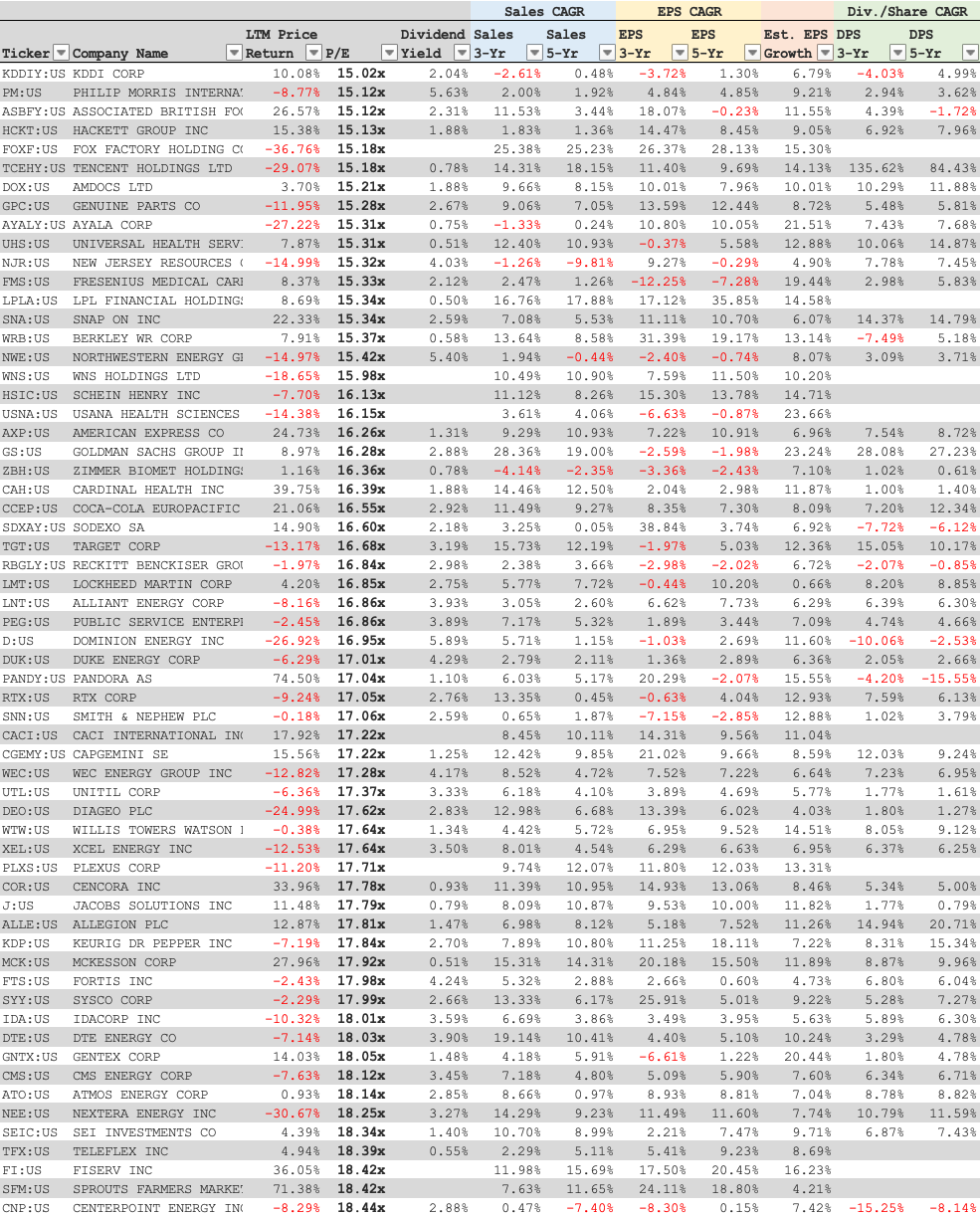

My value screener is designed to track businesses with strong track records of earnings growth, with high adjusted earnings persistency scores.

In other words, I’m screening for high quality businesses with a long track record of price movement that “closely” tracks earnings growth. In doing so, I hope to uncover value candidates that for whatever reason have fallen from the graces of the market gods and are no longer trading in-line with earnings trends. Some of my favorite companies on this list will likely have very low PEG ratios.

This is a work in progress, so please join the discussion! As always, any feedback is very much appreciated as I seek to deliver as much value to you readers as possible.

Comment below on any names that stand out to you! Happy hunting.