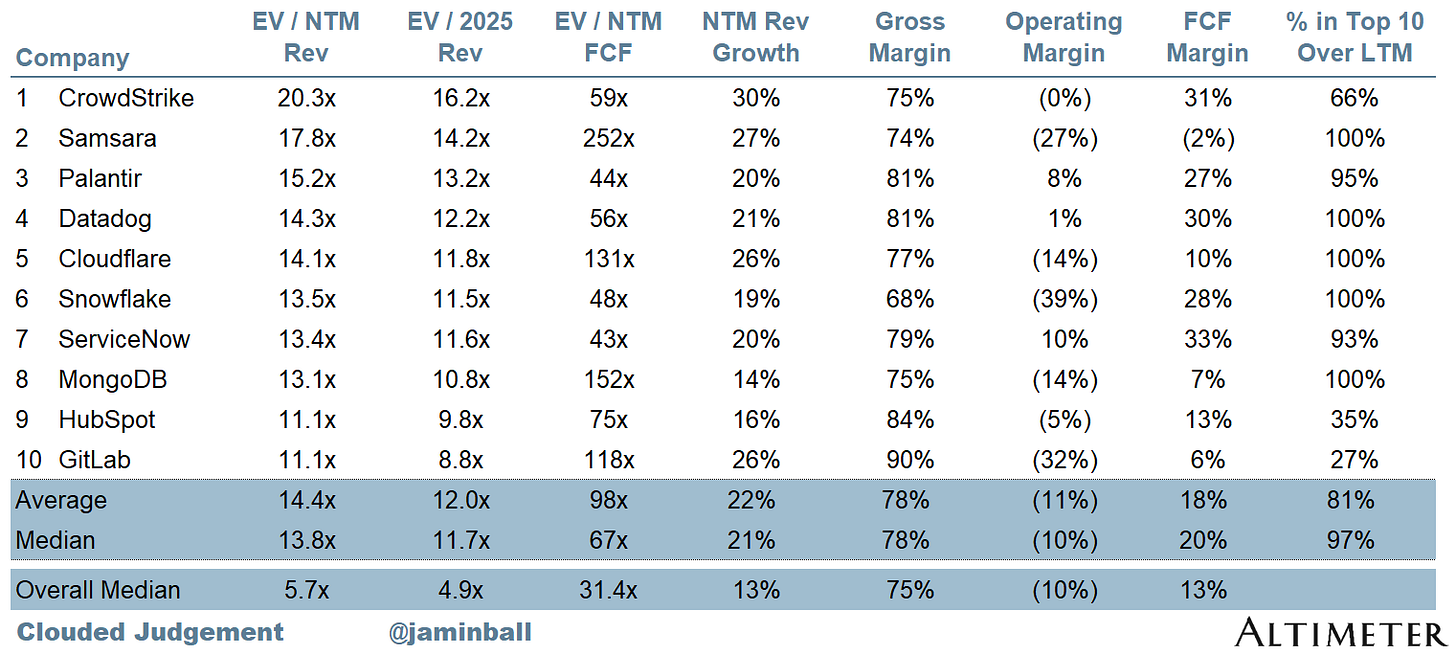

Cybersecurity has performed extremely well over the last year. Three of the top 10 public cloud software companies (as measured by EV/LTM revenue multiples) operate in this sector. CrowdStrike (CRWD 0.00%↑) tops the list and has exploded over 120% over the last twelve months. While the sector is in the midst of a major bull run, one company has had less than stellar performance. SentinelOne (S 0.00%↑) stands out as a unique value proposition after only increasing 2% in the last year, hardly putting a dent in the 50% decline since the company’s IPO in 2021.

TL;DR

Top-line revenue growth in the 90th percentile of all public cloud companies

Net Retention of 115% is in the “best-in-class” category

Rapidly expanding gross margins and path towards profitability

EV/NTM revenue multiple of 6.9x compared to 7.9x for mid-growth median of public cloud companies.

Growth Adjusted EV/NTM of .23x vs .44x for median of all public cloud companies

As always, subscribe if you enjoy the content and join the discussion!

1. Revenue Growth

SentinelOne has maintained an 88.3% top-line CAGR through CY2023 (FYE is January 2024), which places it among the fastest growing public cloud companies.

Growth slowed to 47.2% last year, however, this remains in the 90th percentile of all public cloud comps.

SentinelOne expects to grow top-line revenue at 31% in CY2024, which once again places it well above the 90th percentile of all public cloud comps.

If you compare to one of SentinelOne’s closest comps/competitors in CrowdStrike (CRWD 0.00%↑), SentinelOne has maintained a far superior 3-year top-line CAGR. You would be hard pressed to find a public cloud company who has exhibited a higher rate of top-line growth than SentinelOne over the last several years.

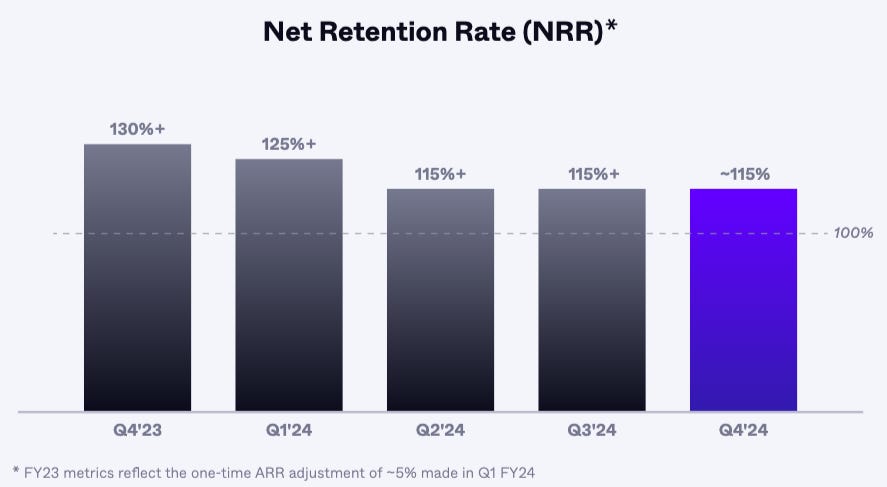

2. Net Revenue Retention

Net Revenue Retention (“NRR”), Net Dollar Retention (“NDR”) and Net Expansion are some of the most important metrics for software companies. They measure the health of a company’s recurring revenue from existing customers. These metrics account not only for churn (lost revenue from departing customers) but also include expansions in spending from existing customers through upsells and cross-sells. High NRR or NDR rates indicate strong customer satisfaction and loyalty, as existing customers are not only staying but also often spending more over time. While technically all different, we’ll use these metrics synonymously as software companies may report on NRR, NDR or simply Net Expansion in their quarterly filings, but they generally act as close enough proxies for the concept. We’ll simply dub this “Net Retention.”

SentinelOne in particular reports on NRR. A Net Retention of 115% places SentinelOne close to the “best-in-class” category, especially considering the challenging environment software companies must endure today.

Compared with CrowdStrike’s Net Retention of 119% as of Q4, this puts the two effectively neck and neck with one another.

The key takeaway here, is that Net Retention directly reflects customer satisfaction and perceived value of the product or service. If customers continue to subscribe and even expand their usage, it likely means they find the product essential and satisfactory. SentinelOne maintains a high Net Retention, in-line with the likes of CrowdStrike, which has performed exceptionally well and maintains the top place in cloud trading multiples.

3. Margins, Profitability & The Rule of 40

When you evaluate margin profile and profitability, you begin to see why S 0.00%↑ is trading at a discount to some of its peers. As markets have tightened, public cloud companies have come under heightened scrutiny around profitability vs. the “growth at all cost” mindset - rightfully so.

While SentinelOne maintains a top-line growth rate well in excess of its comps, it has not yet achieved a positive operating margin and thus has not proven to the market that they can maintain healthy growth rates while being FCF positive.

When you evaluate the top 10 cloud public companies, as measured by EV/NTM revenue multiple, all are effectively FCF positive AND maintain revenue growth rates close to the 90th percentile of all cloud comps.

However, what gives me confidence in SentinelOne is that they have managed to grow and maintain gross margins above 70% over the last several quarters. This still falls below the overall median of 75% for all cloud comps, so it will be critical for management to continue the path towards margin expansion. However, you are seeing the right trend, growing margins from 65% in Q1 FY2023 to 72% in Q4 FY2024. Note, SentinelOne reported a 77% non-GAAP gross margin as of FY2024.

Rule of 40

Combining top-line growth and profitability, it’s important to also evaluate SentinelOne in a more “standardized” framework relative to its comps using the Rule of 40, which accounts for both revenue growth and profit margin.

When evaluating the top trading public cloud companies, most if not all are in the top quartile for the Rule of 40 in both the LTM and NTM (43% and 39%, respectively). CRWD 0.00%↑ for example has a LTM and NTM Rule of 40 of 67% and 62%, respectively.

Where SentinelOne lacks in profitability, it makes back some of the ground in its high top-line growth rate, achieving a LTM and NTM Rule of 40 of 34% and 37%, respectively, placing it right in-line with the top quartile of all public cloud comps.

Runway

The other important note is that SentinelOne had $926M in cash on the balance sheet as of January 2024. If you simply took the operating loss of $79M from Q4 and expected this to be consistent over the foreseeable future, SentinelOne would have almost 12 quarters of runway (aka 3 years). Furthermore, actual burn has been dramatically less, as net income in the latest quarter was less than $7M, down from $57M in Q1 FY2023.

From a capitalization perspective, the business is fine and has plenty of runway to achieve breakeven and prove out profitability over time.

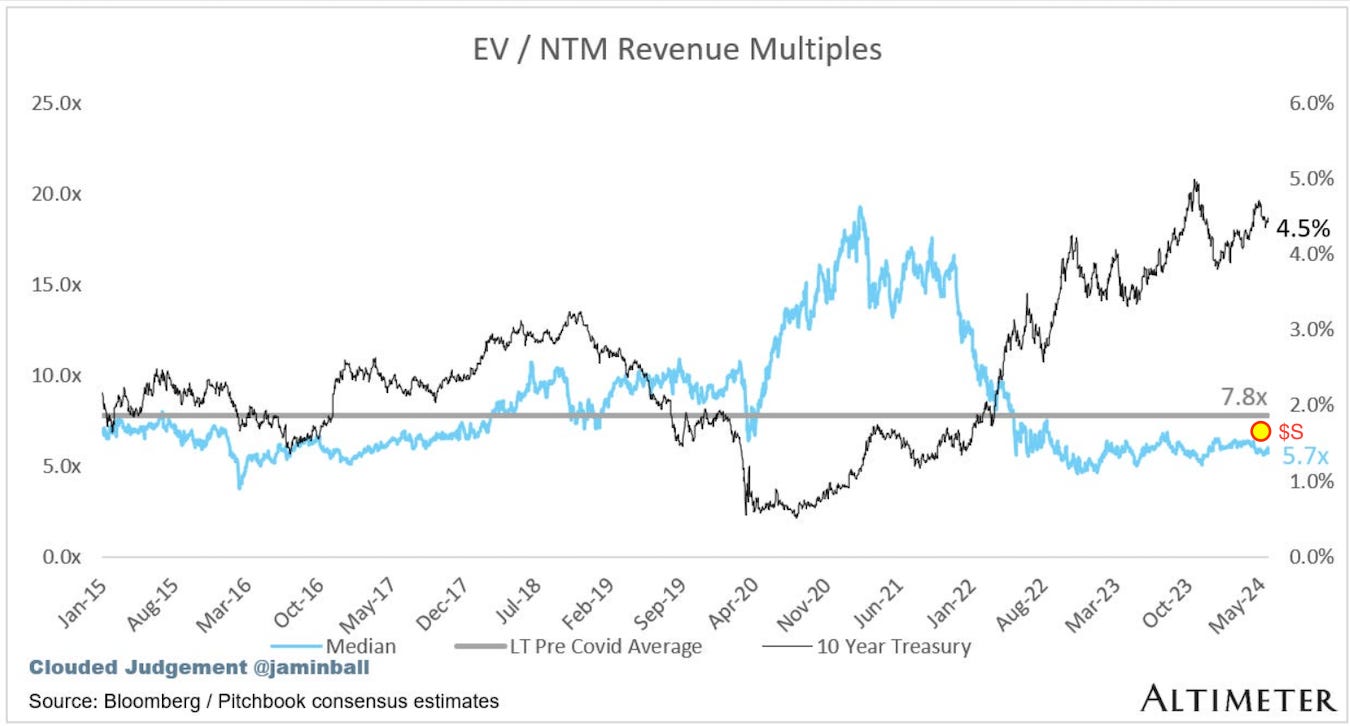

4. EV/NTM Revenue Multiple

Getting into valuation, SentinelOne is attractively priced relative to its high growth rate amongst cloud competitors. From a pure EV/NTM revenue perspective, all cloud companies are probably slightly undervalued at the moment, as the above chart shows the long-term pre-COVID average for the industry was closer to 7.8x. As rates ease (even marginally) cloud multiples should see a healthy level of multiple expansion (i.e. going from 5.7x to 6.7x represents a 17.5% increase due to multiple expansion alone, and this is still below the long-term average).

Evaluating cloud comps based on growth rates, you can see that SentinelOne appears to be reasonably priced, given it falls within the top 90th percentile of all companies by growth rate, yet is valued below the “mid-growth” median of cloud comps.

The point here being, SentinelOne should have the benefit of multiple expansion over time, both as the market gives it more credit for its high growth rate and assuming rates begin to ease over time.

5. Growth Adjusted EV/NTM Revenue Multiple

When you plot S 0.00%↑ against cloud comps as measured by the Growth Adjusted revenue multiple (EV/NTM/NTM Consensus Growth Rate), the company looks very undervalued, even by the long-term average.

In this chart, you can really see just how much room for multiple expansion SentinelOne could have, sitting as the highest growth cloud company, trading far below the trend line which shows the relationship between NTM Revenue Growth and NTM Revenue Multiples. Conversely, CrowdStrike trades at one of the largest premiums to this trend line. Klaviyo (KVYO 0.00%↑) looks attractive down there too…cough, cough.

Concluding Thoughts

Obviously, a lot rides on execution for SentinelOne and getting to repeatable profitability. However, I’m more comfortable with the risk given the high Net Retention rate and the implied leading indicators we discussed. Furthermore, cloud security is an extremely hot category and should see a healthy CAGR over the next decade, as security becomes increasingly important in the age of AI and rapid digital adoption.

I think a 14.5% multiple expansion on EV/NTM revenue (assuming S 0.00%↑ can garner the 7.9x for mid-growth median of public cloud companies) is quite reasonable given the expected growth rates and trend towards profitability for the business.

Note: In the return chart above, multiple is plotted as Price/Sales, which differs from EV/Revenue. The 14.5% multiple expansion was applied to the blended P/S ratio of 9.3x to get the benchmark 10.65x. Blended P/S is based on the average of LTM and NTM revenue.

Assumptions are as follows:

5-Year Sales CAGR: 19.7%

P/S Multiple: 10.65x

The return model is essentially going to assume a marginally lower revenue growth rate over time (reminder: 3-year CAGR was closer to 88%).

Assuming a 10.6x P/S as a benchmark, which is based on a 14.5% expansion to the multiple (see note above below chart).

In the return model, where the business performs well (but below the rates of the last several years), I would anticipate SentinelOne to compound close to 22.6% annually though CY2029, leading to a multi-bagger in just over 5 years.

In general, I think there’s a ton of value in the cloud right now, mainly outside the top 10 trading companies. SentinelOne caught my eye largely due to the high Net Retention rate compared with how low the business was trading on a multiple basis relative to its peers. Pair that with its exceptionally high top-line growth rate and brutal trading performance since going public and you have yourself a strong value proposition!

Q1 Earnings (May 30, 2024)

As a quick note ahead of the company’s Q1 FY2025 earnings tomorrow, I wouldn’t be surprised if the company underwhelms the market (especially after the CRM 0.00%↑ earnings today).

SentinelOne has only missed analysts’ revenue estimates once over the last two years, exceeding top-line expectations by an average 3.6%. Most analysts reaffirmed their estimates over the last 30 days, and industry comps including Varonis and Palo Alto Networks met analyst expectations. If there’s a miss, I think it could be on EPS (-$0.05/share forecast).

Personally, I hope to see continued gross margin expansion and strong NRR metrics. Assuming no major surprises here, I’m generally happy.

I’m personally hoping for an even better buying opportunity, but I don’t recommend timing the market. Maintain a long time horizon and buy when you have conviction!

Join the discussion and let me know your thoughts!

Great analysis thanks for sharing

Thoughts on Earnings from today!!!

https://substack.com/@intrinsicinsights/note/c-57724707